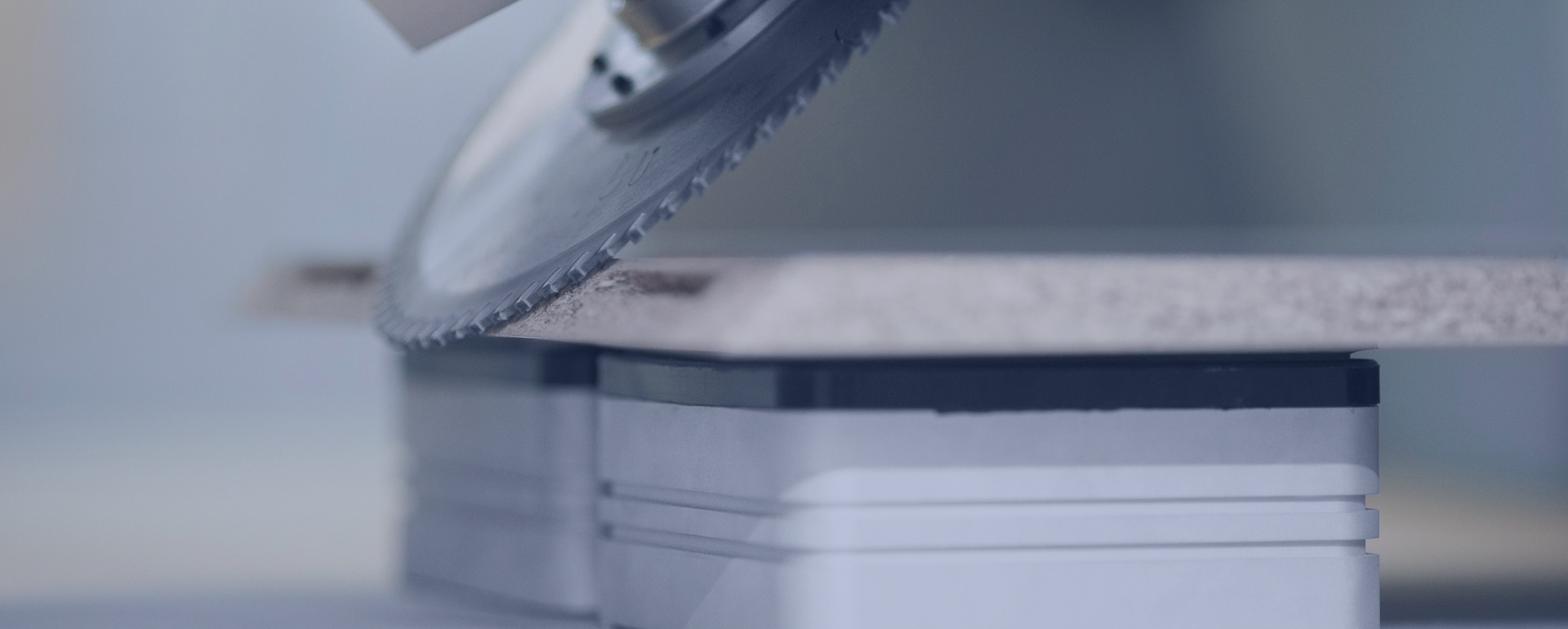

130% Temporary tax reliefs on qualifying capital asset investments

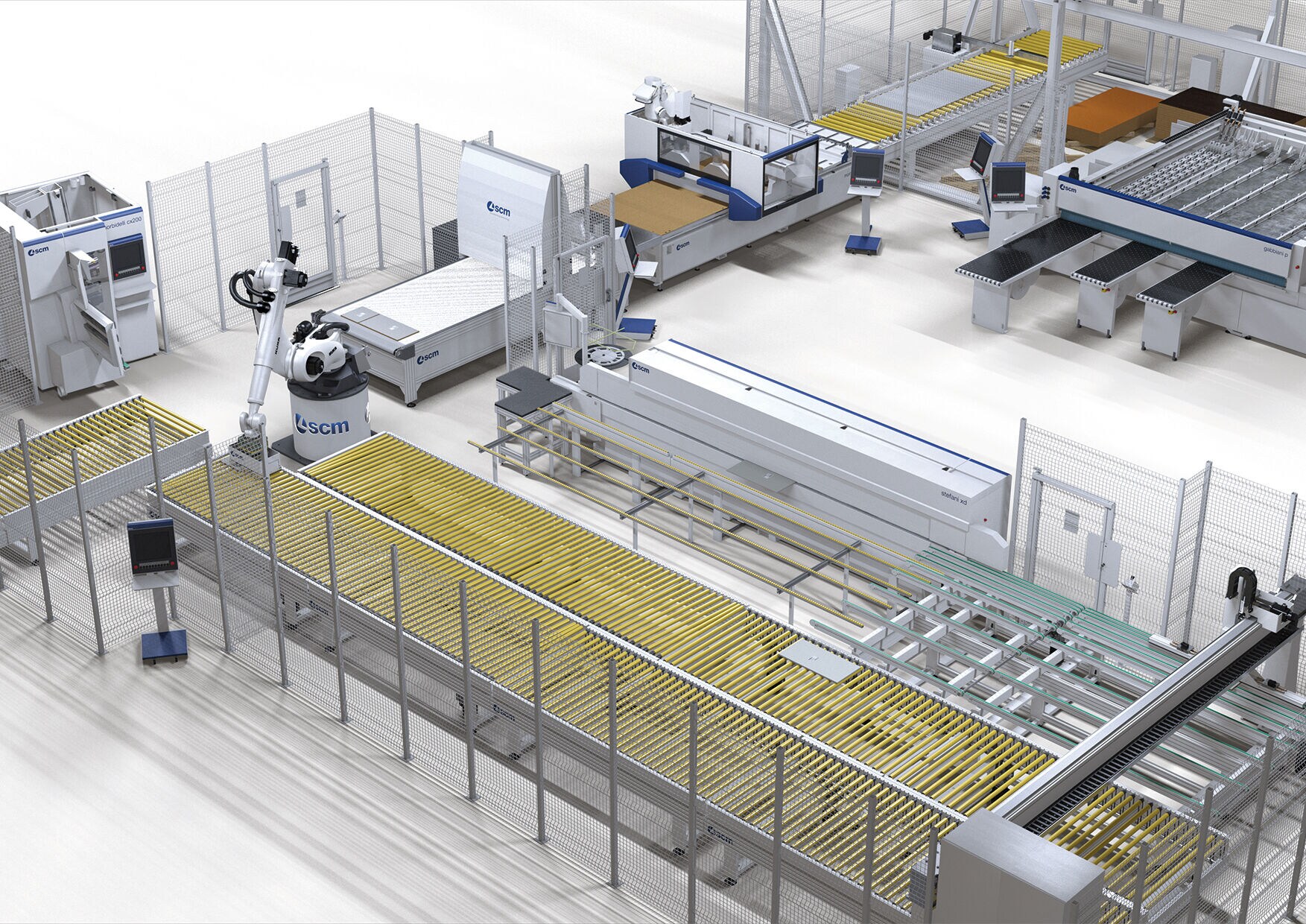

It’s time to look forward, it’s time to invest!*

SCM are very pleased with the Government’s decision to spur capital asset investment to modernize UK production.

Learn More

All manufacturers should look at keeping their equipment up to date to improve their competitiveness and achieve superior levels of safety and workplace welfare. This regardless of fiscal stimuli.

The Government incentive adds the extra encouragement to do so immediately. Looking beyond the mere substitution of obsolete equipment, the opportunity should be taken to aim towards revisiting the production process, increasing flexibility and customization, delivering outstanding finish, improving sustainability and the adoption of Industry 4.0 solutions to drive performance supported by readily available data.

Only a handful of superior equipment suppliers like SCM can offer all of this,

and the added benefit of a 130% temporary tax relief on qualifying capital asset investments eliminates logical justifications to wait any longer to do so.

It's temporary: catch the benefit while it is here!

FOR MORE INFORMATION

What is the Super-Deduction Tax break?

The Super-Deduction £25bn tax break, announced in the March 2021 Budget, is intended to spur investment by providing 25p off company tax bills for every £1 of qualifying spending on plant and machinery.

How the super-deduction works.

The Super-Deduction offers 130% first-year relief on qualifying main rate plant and machinery and most other business equipment investments from April 1 2021 until March 31 2023 for companies.

This will mean that on a spend of £100,000, the corporation tax deduction will be £130,000, giving corporation tax relief at 19% on £130,000, which is £24,700.

Normally, such expenditure would fall within a company’s Annual Investment Allowance (AIA) and produce relief of only £19,000.

Example one:

A company buying a new machine for £25,000 would previously have been able to offset tax @ 19% on this under the current AIA, so £4,750.

Under the new Super Deduction scheme the company would receive 130% of the machine cost as allowances (£32,500) so would be able to offset £6,175 as tax at 19%.

Example two:

A company making £200,000 of Capital Investment in qualifying equipment over the year would previously have been able to offset tax @ 19% on this under the current AIA, so £38,000.

Under the new Super Deduction scheme the company would receive 130% of the investment cost as allowances (£260,000) so would be able to offset £49,400 as tax at 19%.

FOR MORE INFORMATION